Open Interest is the total number of outstanding contracts that are held by market participants at the end of each day. Where volume measures the pressure or intensity behind a price trend, open interest measures the flow of money into the futures market. For each seller of a futures contract, there must be a buyer of that contract. Thus, a seller and a buyer combine to create only one contract. Therefore, to determine the total open interest for any given market we need only to know the totals from one side or the other, buyers or sellers, not the sum of both.

Each trade completed on the floor of a futures exchange has an impact on the level of open interest for that day. For example, if both parties to the trade are initiating a new position (one new buyer and one new seller), open interest will increase by one contract. If both traders are closing an existing or old position ( one old buyer and one old seller) open interest will decline by one contract. The third and final possibility is one old trader passing off his position to a new trader ( one old buyer sells to one new buyer). In this case, the open interest will not change. By monitoring the changes in the open interest figures at the end of each trading day, some conclusions about the day’s activity can be drawn. Increasing open interest means that new money is flowing into the marketplace. The result will be that the present trend (up, down, or sideways) will continue. Declining open interest means that the market is liquidating and implies that the prevailing price trend is coming to an end. A knowledge of open interest can prove useful toward the end of major market moves. A leveling off of steadily increasing open interest following a sustained price advance is often an early warning of the end of an up-trending or bull market.

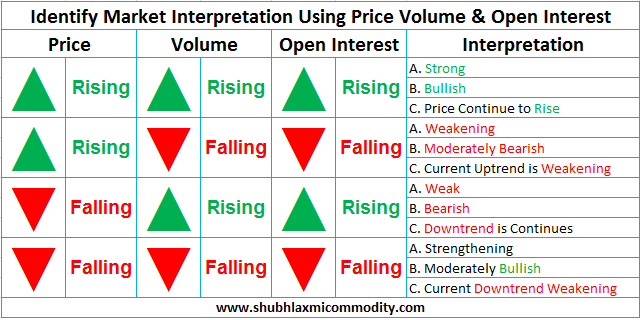

The relationship between the prevailing price trend, volume, and open interest can be summarized in the following table.